- #2022 tax brackets standard deduction for free#

- #2022 tax brackets standard deduction pdf#

- #2022 tax brackets standard deduction free#

Tax returns that are due on Tax Day, but can be filed late.

#2022 tax brackets standard deduction pdf#

Open this PDF with state-related standard deductions and tax brackets.

#2022 tax brackets standard deduction free#

Want to get IT done? Sign up free here and eFileIT - current year returns only.

#2022 tax brackets standard deduction for free#

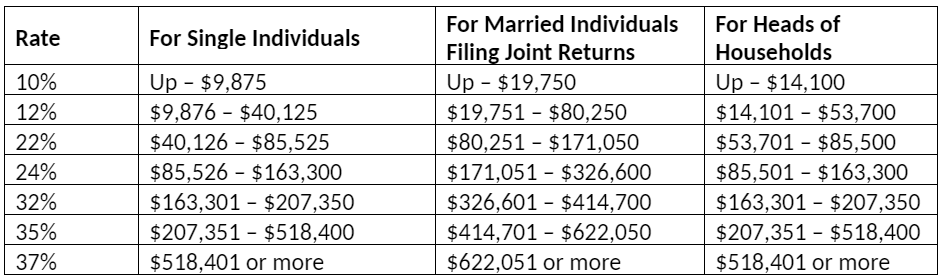

If all this reading is not for you, simply estimate your next tax return for free and get real results as they only apply to your tax situation. As a result of the 2018 tax reform, the standard deductions have increased significantly, but many other deductions got discontinued as a result of the same tax reform. These standard deductions will be applied by tax year for your IRS tax return most states also have a standard deduction. For forms and publications, visit the Forms and Publications search tool.IRS Standard Tax Deductions for Back Taxes We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La página principal en español (Spanish home page). These pages do not include the Google™ translation application.

We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Visit 2022 Instructions for Schedule CA (540) or 2022 Instructions for Schedule CA (540NR) for more information.

Job Expenses and Certain Miscellaneous Itemized DeductionsĮxpenses that exceed 2% of your federal AGI

Expenses that exceed 7.5% of your federal AGI

0 kommentar(er)

0 kommentar(er)